Register now or log in to join your professional community.

ABC costing can be applied for implementation this system.

Step 1. Identify costly activities required to complete products.

An activity is any process or procedure that consumes overhead resources. The goal is to understand all the activities required to make the company’s products. This requires interviewing and meeting with personnel throughout the organization. Companies that use activity-based costing, such asHewlett Packard and IBM, may identify hundreds of activities required to make their products. The most challenging part of this step is narrowing down the activities to those that have the biggest impact on overhead costs.

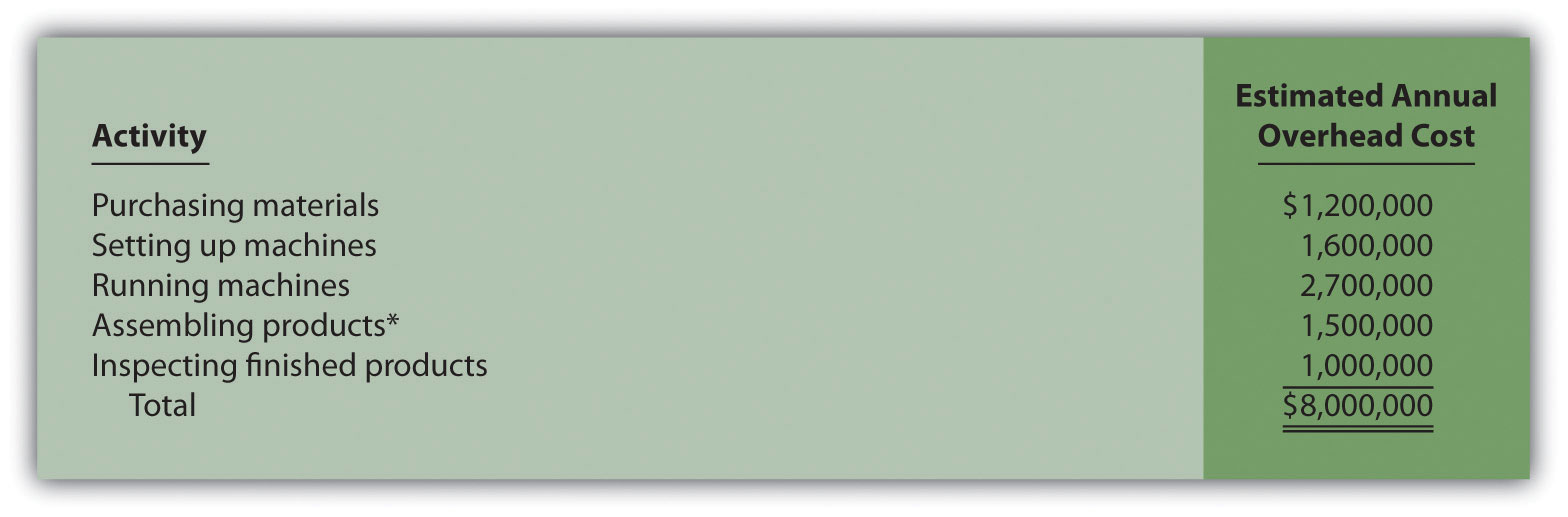

After meeting with personnel throughout the company, SailRite’s accountant identified the following activities as having the biggest impact on overhead costs:

Step 2. Assign overhead costs to the activities identified in step 1.

This step requires that overhead costs associated with each activity be assigned to the activity (i.e., a cost pool is formed for each activity). For SailRite, the cost pool for the purchasing materials activity will include costs for items such as salaries of purchasing personnel, rent for purchasing department office space, and depreciation of purchasing office equipment.

The accountant at SailRite developed the following allocations after careful review of all overhead costs (remember, these are overhead costs, not direct materials or direct labor costs):

*We should note that this is not the direct labor cost. Instead, this represents overhead costs associated with assembling products, such as supplies and the factory space being used for assembly.

At this point, we have identified the most important and costly activities required to make products, and we have assigned overhead costs to each of these activities. The next step is to find an allocation base that drives the cost of each activity.

Step 3. Identify the cost driver for each activity.

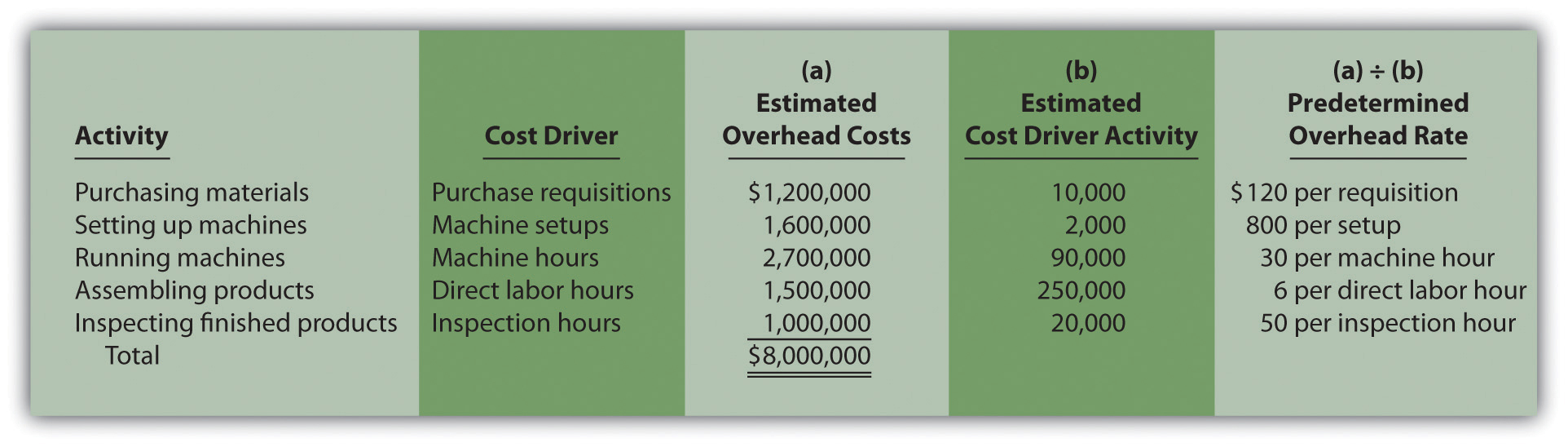

A cost driver is the action that causes (or “drives”) the costs associated with the activity. Identifying cost drivers requires gathering information and interviewing key personnel in various areas of the organization, such as purchasing, production, quality control, and accounting. After careful scrutiny of the process required for each activity, SailRite established the following cost drivers:

Activity Cost Driver Estimated Annual Cost Driver Activity Purchasing materials Purchase requisitions 10,000 requisitions Setting up machines Machine setups 2,000 setups Running machines Machine hours 90,000 hours Assembling products Direct labor hours 250,000 hours Inspecting finished products Inspection hours 20,000 hoursNotice that this information includes an estimate of the level of activity for each cost driver, which is needed to calculate a predetermined rate for each activity in step 4.

Step 4. Calculate a predetermined overhead rate for each activity.

This is done by dividing the estimated overhead costs (from step 2) by the estimated level of cost driver activity (from step 3). Figure 3.4 “Predetermined Overhead Rates for SailRite Company” provides the overhead rate calculations for SailRite Company based on the information shown in the previous three steps. It shows that products will be charged $120 in overhead costs for each purchase requisition processed, $800 for each machine setup, $30 for each machine hour used, $6 for each direct labor hour worked, and $50 for each hour of inspection time.

Figure 3.4 Predetermined Overhead Rates for SailRite Company

Step 5. Allocate overhead costs to products.

Overhead costs are allocated to products by multiplying the predetermined overhead rate for each activity (calculated in step 4) by the level of cost driver activity used by the product. The term applied overhead is often used to describe this process.

Assume the following annual cost driver activity takes place at SailRite for the Basic and Deluxe sailboats: [1]

Activity Basic Sailboat Deluxe Sailboat Total Purchasing materials 7,000 requisitions 3,000 requisitions 10,000 requisitions Setting up machines 1,100 setups 900 setups 2,000 setups Running machines 50,000 hours 40,000 hours 90,000 machine hours Assembling products 200,000 hours 50,000 hours 250,000 direct labor hours Inspecting finished products 12,000 hours 8,000 hours 20,000 inspection hoursFigure 3.5 “Allocation of Overhead Costs to Products at SailRite Company” shows the allocation of overhead using the cost driver activity just presented and the overhead rates calculated in Figure 3.4 “Predetermined Overhead Rates for SailRite Company”. Notice that allocated overhead costs total $8,000,000. This is the same cost figure used for the plantwide and department allocation methods we discussed earlier. Activity-based costing simply provides a more refined way to allocate the same overhead costs to products.

Figure 3.5 Allocation of Overhead Costs to Products at SailRite Company

*Overhead allocated equals the predetermined overhead rate times the cost driver activity.

**Overhead cost per unit for the Basic model equals $5,020,000 (overhead allocated) ÷ 5,000 units produced, and for the Deluxe model, it equals $2,980,000 ÷ 1,000 units produced.

The bottom of Figure 3.5 “Allocation of Overhead Costs to Products at SailRite Company” shows the overhead cost per unit for each product assuming SailRite produces 5,000 units of the Basic sailboat and 1,000 units of the Deluxe sailboat. This information is needed to calculate the product cost for each unit of product, which we discuss next.

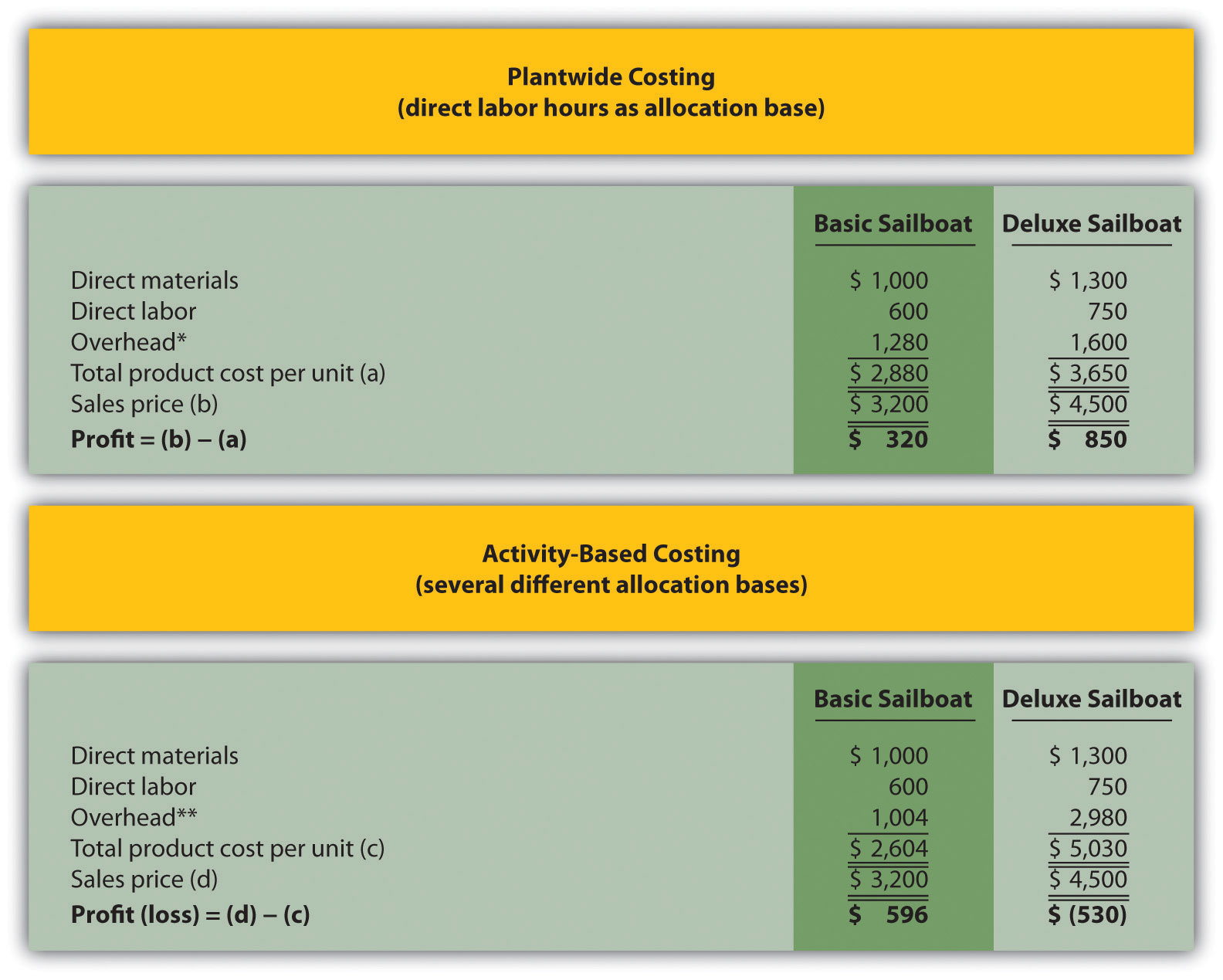

Product Costs Using the Activity-Based Costing Approach at SailRiteQuestion: As shown in Figure 3.5 “Allocation of Overhead Costs to Products at SailRite Company”, SailRite knows the overhead cost per unit using activity-based costing is $1,004 for the Basic model and $2,980 for the Deluxe. Now that SailRite has the overhead cost per unit, how will the company find the total product cost per unit and resulting profit?

Answer: Recall from our discussion earlier that the calculation of a product’s cost involves three components—direct materials, direct labor, and manufacturing overhead. Assume direct materials cost $1,000 for the Basic sailboat and $1,300 for the Deluxe. Direct labor costs are $600 for the Basic sailboat and $750 for the Deluxe. This information, combined with the overhead cost per unit calculated at the bottom of Figure 3.5 “Allocation of Overhead Costs to Products at SailRite Company”, gives us what we need to determine the product cost per unit for each model, which is presented in Figure 3.6 “SailRite Company Product Costs Using Activity-Based Costing”. The average sales price is $3,200 for the Basic model and $4,500 for the Deluxe. Using the product cost information in Figure 3.6 “SailRite Company Product Costs Using Activity-Based Costing”, the Basic model yields a profit of $596 (= $3,200 price – $2,604 cost) per unit and the Deluxe model yields a loss of $530 (= $4,500 price – $5,030 cost) per unit.

Figure 3.6 SailRite Company Product Costs Using Activity-Based Costing

As you can see in Figure 3.6 “SailRite Company Product Costs Using Activity-Based Costing”, overhead is a significant component of total product costs. This explains the need for a refined overhead allocation system such as activity-based costing.

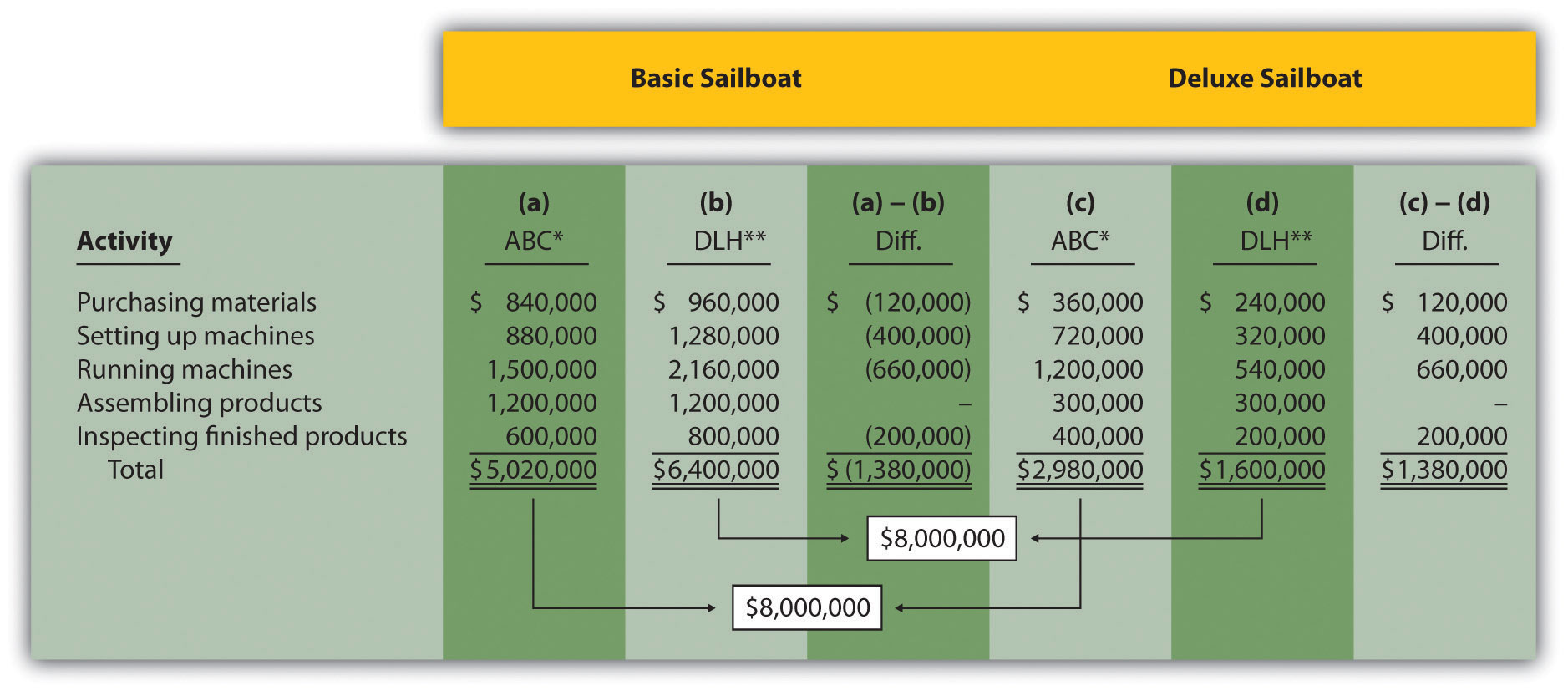

Comparison of ABC to Plantwide Costing at SailRiteAfter going through the process of allocating overhead using activity-based costing, John Lester (the company accountant) called a meeting with the same management group introduced at the beginning of the chapter: Cindy Hall (CEO), Mary McCann (vice president of marketing), and Bob Schuler (vice president of production). As you read the following dialogue, refer to Figure 3.7 “Activity-Based Costing Versus Plantwide Costing at SailRite Company”, which summarizes John’s findings.

Cindy: What do you have for us, John? John: I think you’ll find the results of our most recent costing analysis very interesting. We used an approach called activity-based costing to allocate overhead to products. Bob: I recall being interviewed last week about the activities involved in the production process. John: Yes, here’s what we found. The old allocation approach indicates that the Basic boat costs $2,880 to build and the Deluxe boat costs $3,650 to build. Our average sales price for the Basic is $3,200 and $4,500 for the Deluxe. You can see why we pushed sales of the Deluxe boat—it has a profit of $850 per boat. Cindy: John, from your analysis, it looks as if we were wrong about the Deluxe boat being the most profitable. John: We do have some startling results. Using activity-based costing, an approach I think is much more accurate, the Deluxe boat is not profitable at all. In fact, we lose $530 for each Deluxe boat sold, and the profits from the Basic boat are much higher than we thought at $596 per unit. Cindy: I see direct materials and direct labor are the same no matter which costing system we use. Why is there such a large variation in overhead costs? John: Good question! When we used our old approach of one plantwide rate based on direct labor hours, the Deluxe process consumed 20 percent of all direct labor hours worked—that is, 50,000 Deluxe hours divided by 250,000 total hours. Therefore the Deluxe model was allocated 20 percent of all overhead costs. Using activity-based costing, we identified five key activities and assigned overhead costs based on the use of these activities. The Deluxe process consumed more than 20 percent of the resources provided for every activity. For example, running machines is one of the most costly activities, and the Deluxe model used about 44 percent of the resources provided by this activity. This is significantly higher than the 20 percent allocated using direct labor hours under the old approach. Bob: This certainly makes sense! Each Deluxe boat takes a whole lot more machine hours to produce than the Basic boat. Cindy: Thanks for this analysis, John. Now we know why company profits have been declining even though sales have increased. Either the Deluxe sales price must go up or costs must go down—or a combination of both!Figure 3.7 Activity-Based Costing Versus Plantwide Costing at SailRite Company

*From Figure 3.2 “SailRite Company Product Costs Using One Plantwide Rate Based on Direct Labor Hours”.

**From Figure 3.5 “Allocation of Overhead Costs to Products at SailRite Company”.

Question: SailRite has more accurate product cost information using activity-based costing to allocate overhead. Why is the overhead cost per unit so different using activity-based costing?

Answer: Figure 3.8 “Detailed Analysis of Overhead Allocations at SailRite Company” provides a more thorough look at how the Deluxe product consumes a significant share of overhead resources—much higher than the 20 percent that was being allocated based on direct labor hours. Let’s look at Figure 3.8 “Detailed Analysis of Overhead Allocations at SailRite Company” in detail:

Figure 3.8 Detailed Analysis of Overhead Allocations at SailRite Company

*Amounts in this column come from Figure 3.5 “Allocation of Overhead Costs to Products at SailRite Company”.

**Amounts in this column are calculated by multiplying 80 percent for the Basic boat (20 percent for the Deluxe) by the total overhead cost for the activity. For example, the total overhead cost for purchasing materials is $1,200,000 (see Figure 3.4 “Predetermined Overhead Rates for SailRite Company”) and $1,200,000 × 80 percent = $960,000. Using the plantwide approach (one plantwide rate based on direct labor hours), $960,000 is the amount allocated to the Basic sailboat for this activity, and $240,000 is the amount allocated to the Deluxe boat.

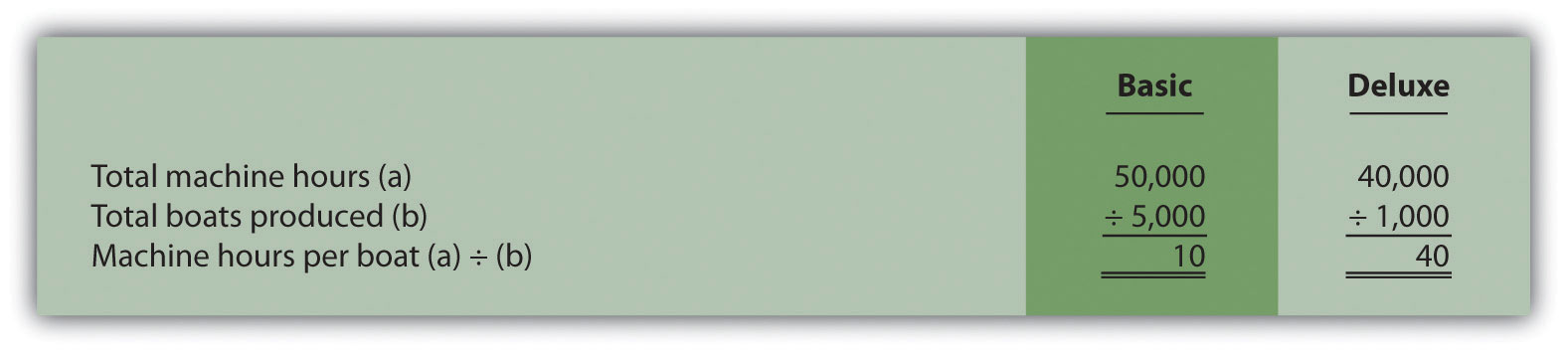

The primary reason that using activity-based costing shifted overhead costs to the Deluxe sailboat is that producing each Deluxe boat requires more resources than the Basic boat. For example, the Basic boat requires 50,000 machine hours to produce 5,000 boats, and the Deluxe boat requires 40,000 machine hours to produce 1,000 boats. The number of machine hours required per boat produced is as follows:

You can see from this analysis that the Deluxe boat consumes four times the machine hours of the Basic boat. At a rate of $30 per machine hour, the Deluxe boat is assigned $1,200 per boat for this activity ($30 rate × 40 machine hours) while the Basic boat is assigned $300 per boat ($30 rate × 10 machine hours).

thanks for the invitation

This system follows the enterprises that produce goods with special specifications according to the customer's wishes, are assembling a production cost of each command separately, unlike the stages that follow in industries that produce goods typically goes through various stages until they become final product costs.

Examples of industries where used commands costs (furniture factories, clothing, shipbuilding, printing presses, and maintenance workshops).

It commands the costs of system characteristics: -

1. Non-typical production carried out according to the requests and specifications of the customer, then you can distinguish each of the commands is produced under the operating units.

2. The production centers, industrial processes based on production orders, or operating orders issued by the competent authority.

3. calculates the cost components for each productive ordered separately, on the basis of its own inventory cost elements at each of the different centers.

4. This system facilitates the inventory of internal services costs (such as maintenance), in preparation for loading onto sections or beneficiary centers.

5. The operating schedule for each command centers of production going through them all, and each cost rates of order, or a separate download.

6. facilitate the determination of the profit or loss of each command productive, immediately upon completion of the run, and by comparing the cost of selling price for this.

Steps or action (s) accounting for the costs of commands: -

1. After the agreement with the customer's production is exported (operating) includes a series of practical specifications, quantity and date of commencement of operation and the period set for the end of Menna and handed over a number.

2. open a separate account cost management ledger productivity commands professor (assistant) called (cost) card or (Cost Report) holds this account of direct materials, direct labor and the share of industrial production is indirect costs (using loading rates).

3. The production orders are accounts by production control orders under the operating costs of account control, Verhal him at the end of the period the total costs proved in detail in the cards cost elements.

4. closed production orders accounts under operating (costs) cards at the expense of full production of the stores when they are completed, and then leave to calculate the cost of sales when they are delivered to the customer to meet sales revenue, and if not delivered during the accounting period are shown within the balance of h / monitor stores ready products (full produce stores).

5. represent production orders under the operating cost at the end of the accounting period under the operating output value (ie the sum of orders is the full cost at the end of the period), which represents the balance of h / production control orders under the operation.

(Meaning the remaining part under any operating is not finished showing him an asset in the H / output control orders under the operating).

thanks for the invitation

This system follows the enterprises that produce goods with special specifications according to the customer's wishes, are assembling a production cost of each command separately, unlike the stages that follow in industries that produce goods typically goes through various stages until they become final product costs.

Examples of industries where used commands costs (furniture factories, clothing, shipbuilding, printing presses, and maintenance workshops).

It commands the costs of system characteristics: -

1. Non-typical production carried out according to the requests and specifications of the customer, then you can distinguish each of the commands is produced under the operating units.

2. The production centers, industrial processes based on production orders, or operating orders issued by the competent authority.

3. calculates the cost components for each productive ordered separately, on the basis of its own inventory cost elements at each of the different centers.

4. This system facilitates the inventory of internal services costs (such as maintenance), in preparation for loading onto sections or beneficiary centers.

5. The operating schedule for each command centers of production going through them all, and each cost rates of order, or a separate download.

6. facilitate the determination of the profit or loss of each command productive, immediately upon completion of the run, and by comparing the cost of selling price for this.

Steps or action (s) accounting for the costs of commands: -

1. After the agreement with the customer's production is exported (operating) includes a series of practical specifications, quantity and date of commencement of operation and the period set for the end of Menna and handed over a number.

2. open a separate account cost management ledger productivity commands professor (assistant) called (cost) card or (Cost Report) holds this account of direct materials, direct labor and the share of industrial production is indirect costs (using loading rates).

3. The production orders are accounts by production control orders under the operating costs of account control, Verhal him at the end of the period the total costs proved in detail in the cards cost elements.

4. closed production orders accounts under operating (costs) cards at the expense of full production of the stores when they are completed, and then leave to calculate the cost of sales when they are delivered to the customer to meet sales revenue, and if not delivered during the accounting period are shown within the balance of h / monitor stores ready products (full produce stores).

5. represent production orders under the operating cost at the end of the accounting period under the operating output value (ie the sum of orders is the full cost at the end of the period), which represents the balance of h / production control orders under the operation.

(Meaning the remaining part under any operating is not finished showing him an asset in the H / output control orders under the operating).

Activity-based costing is a method of assigning indirect costs to products and services which involves finding cost of each activity involved in the production process and assigning costs to each product based on its consumption of each activity.

Activity-based costing is more refined approach to costing products and services than the traditional costing method.

It involves the following steps:

Identification of activities involved in the production process;

Classification of each activity according to the cost hierarchy (i.e. into unit-level, batch-level, product level and facility level);

Identification and accumulation of total costs of each activity

Identification of the most appropriate cost driver for each activity

Calculation of total units of the cost driver relevant to each activity

Calculation of the activity rate i.e. the cost of each activity per unit of its relevant cost driver

Application of the cost of each activity to products based on its activity usage by the product.

Activity Based Costing (ABC) is a two-stage product costing method that assigns costs first to activities and then to the products based on each product's use of activities.

An activity is any discrete task that an organization undertakes to make or deliver a product or service.

Activity-based costing is based on the concept that products consume activities and activities consume resources.

Activity-based costing involves the following four steps:

1.- Identify the activities -such as processing orders- that consume resources and assign costs to them.

2.- Identify the cost driver(s) associated with each activity. A cost driver causes, or "drives" an activity's costs. For the order-processing activity, the cost driver could be the number of orders.

3.- Compute a cost rate per cost driver unit or transaction. The cost driver rate could be the cost per order, for example.

4.- Assign costs to products by multiplying the cost driver rate by the volume of cost driver units consumed by the product. For example, the cost per order multiplied by the number of orders processed for a particular song during the month of March measures the cost of the order processing activity for that song during March.

Identifying activities that use resources. Often the most interesting and challenging part of the excercise is identifying activities that use resources because doing so requires understanding all activities required to make a product. In fact, much of the value of activity-based costing comes from this excercise even without changing the way product costs are computed. When managers step back and analize the processes (activities) they follow to produce a good or service, they often uncover many nonvalue-added steps, which they can eliminate.

Choosing cost driver.

The following table shows several examples of the types of cost drivers that companies use.

Most are related either to the volume of production or to the complexity of the production or marketing process.

I fully agree with expert answers

The main steps in the implementation of a system of costs by order are:

The concept of cost object is a useful concept to identify and track costs. A cost object is used to answer the question "how much does something?".

Do you need help in adding the right keywords to your CV? Let our CV writing experts help you.