Register now or log in to join your professional community.

Financial accounting has its focus on the financial statements which are distributed to stockholders, lenders, financial analysts, and others outside of the company. Courses in financial accounting cover the generally accepted accounting principles which must be followed when reporting the results of a corporation's past transactions on its balance sheet, income statement, statement of cash flows, and statement of changes in stockholders' equity.Managerial accounting has its focus on providing information within the company so that its management can operate the company more effectively. Managerial accounting and cost accounting also provide instructions on computing the cost of products at a manufacturing enterprise. These costs will then be used in the external financial statements. In addition to cost systems for manufacturers, courses in managerial accounting will include topics such as cost behavior, break-even point, profit planning, operational budgeting, capital budgeting, relevant costs for decision making, activity based costing, and standard costing.

In terms of the data:

Financial accounting relies on historical data

Accounting and management scheme based on the ability of data and actual data and historical data Mqarndthaotstkhaddm Kastrashad data

In terms of the audience of users:

Financial accounting is based on external users and external parties Service of taxes, banks, lenders and investors as well as to owners

Management Accounting serves as an information system serves the administration basically make their own decisions and even rationalize those decisions based on the plant include diverse sections Service

In terms of method of data collection:

Financial accounting is based on the data he has already occurred from

During the financial documents, books and records and financial statements reflect the impact of those

Data on the financial position

Managerial accounting

Based on the financial statements and Kemah, such as performance reports and cost reports are used

Aslib Sports such operations, statistics, linear programming and programming objectives Research

To reach the optimal solution and the right to choose between alternatives and examine some decisions

Such as manufacturing or purchasing decision and the decision of leasing or purchase premium or

Cache purchase decisions, as well as adding new energy

Vulnerability to external environment

Financial Accounting affected by the external environment in terms of legislation and laws and policies of customers, suppliers and competitors

Accounting and management are affected by the environment of the Interior, where most decisions are affected by the addition of a new product or a new product line or add new energy or additional investment

The impact of other sciences it

Financial Accounting influenced by science and other accounting as affected by the review in terms of data presentation and disclosure

Accounting administrative affected by other sciences such as economics, as well as

Operations Research and Mathematics, where she uses those theories and methods in

Choose between alternatives and choose the best

Management Accountant role in decision-making

Management accounting is that the information system which is based

To submit reports in deciding what or even assist management in decision

A decision such as the expansion or the purchase or decisions made or the decision to add new energy

Or the closure of a section.

The accountant's role is to provide the reports in this regard are

Convenience in terms of the appropriate reports and data to decision-makers and help them

In the decision-making to provide advice and counsel.

Provide those decisions in time

Appropriate in order to be sound decision-making as to the timing of great importance to the success of

Such decisions, and where one of the female students showed that the delay in the Management Accountant

Reporting on the opening of a new branch affect up big on the success of the decision.

And also appropriate in terms of substance

Reports and as the report is a letter addressed to his decision Mtkhadd background

A cultural certain administrative accountant must be taken into account it is not supposed to

The user aware of all the merits and backgrounds, but it provides that the report in the form of

The concept is simple then the director of production need to report differs in content and content but

The figure for the estimate submitted to the President of the Board of Directors.

Taking in the degree of certainty reliability to rely on it in the neighborhood of data

Mazha mostly discretionary data affected Bmaadi those reports in terms of expertise

The referee personal and cultural background and areas of interest

Financial data, as well as report all Maevid in decision-making

The output of the accounting system and management standards to measure efficiency:

Accounting system output management as one of Accounting Information Systems is

In graphical reports and budgets and lists such as the list of planned discretionary income

And planning budgets and lists the estimated cash Altvqat The degree of success

Those reports on the method of data collection, such as financial costs and revenues

Planned and non-financial quantity such as sales volume and market share of all property

It depends on the degree of certainty as well as the period in which they are reportable and Whenever

Smaller period whenever they are useful data, we find that the reporting quarter Alvtre

Annual offered by the financial management of the feasibility of the largest annual lists

As well as the daily cost reports are more useful in decision making for those

Weekly or monthly

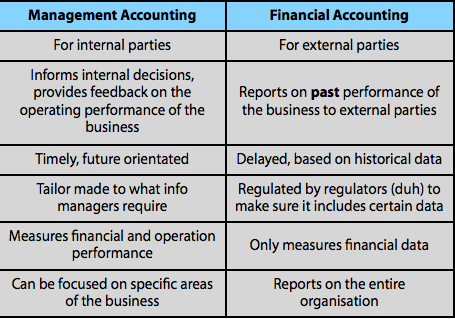

Management accounting is presented internally, whereas financial accounting is meant for external stakeholders. Although financial management is of great importance to current and potential investors, management accounting is necessary for managers to make current and future financial decisions. Financial accounting is precise and must adhere to Generally Accepted Accounting Principles (GAAP), but management accounting is often more of a guess or estimate, since most managers do not have time for exact numbers when a decision needs to be made.

thanks for the invitation as experts already answered this question.

Usually Financial accounting concern is the company's regular financial statements (Financial position, Income Statement, Statement of cash flows, and statement of canges in equity). These statements could be required for insders or outsiders like vendoers , bankers and other creditors , or potential investors who might be interested in measuring the company's performance and financial strength. Financial accounting is based on the company's historical records.

Whereas management accounting works on both historical and forecasted data to provide future projection. Management (managerial accounting) focus is providing useful reporting to the company's management. Management accounting reports would be created for the internal use within the company and for the benefit of the decision making process.

Financial accounting is the process of reporting the results and effects of the financial transactions that a business undertakes. The objective of financial reporting is to provide financial information about the entity that is useful for decision-making. Those using the financial information to make decisions include present and potential equity investors, lenders, and other creditors who need to make decisions about providing resources to the entity. The decisions relate to buying, selling, or holding debt or equity instruments and providing credit. In order to make these decisions, investors, lenders and other creditors need information that will help them assess the amount of, timing of, and prospects for future net cash inflows to the entity.

Managerial accounting is the process of identifying, measuring, analyzing, interpreting and communicating information for the pursuit of an organization's goals

The user of Manegerial accountant are internal only but the users of financial accounting are internal and ecternals.

A common question is to explain the differences between financial accounting and managerial accounting, since each one involves a distinctly different career path. In general, financial accounting refers to the aggregation of accounting information into financial statements, while managerial accounting refers to the internal processes used to account for business transactions.

There are a number of differences between financial and managerial accounting, which fall into the following categories:

There is also a difference in the accounting certifications typically found in each of these areas. People with the Certified Public Accountant designation have been trained in financial accounting, while those with the Certified Management Accountant designation have been trained in managerial accounting.

Pay levels tend to be higher in the area of financial accounting and somewhat lower for managerial accounting, perhaps because there is a perception that more training is required to be fully conversant in financial accounting.

I have already explained the point in another question. The same is reproduced here:

Principal users:

Financial accounts- External. i.e Shareholders, Government, Lenders etc.

Management accounts- Internal. i.e management

Basic purpose:

Financial accounts- To present a view of business's financial performance during an accounting period and financial position at a specific point of time.

Management accounts- Measuring and controlling

I agree with your answer distinctive

Thank you for the invitation

thank you for your invitation.......I agree with answer MR.georgei assi and MR.mohamedm ohamed azmy gwely

Financial accounting produces information that is used by external parties, such as shareholders and lenders.

Managerial accounting produces information that is used within an organization, by managers and employees.

Do you need help in adding the right keywords to your CV? Let our CV writing experts help you.