Inscrivez-vous ou connectez-vous pour rejoindre votre communauté professionnelle.

A- inventory B- A/R C- prepaid expenses D- fixed assets

a liquidity ratio that measures the ability of a company to pay its current liabilities when they come due with only quick assets. Quick assets are current assets that can be converted to cash within90 days or in the short-term. Cash, cash equivalents, short-term investments or marketable securities, and current accounts receivable are considered quick assets.

Short-term investments or marketable securities include trading securities and available for sale securities that can easily be converted into cash within the next90 days. Marketable securities are traded on an open market with a known price and readily available buyers. Any stock on the New York Stock Exchange would be considered a marketable security because they can easily be sold to any investor when the market is open.

The quick ratio is often called the acid test ratio in reference to the historical use of acid to test metals for gold by the early miners. If the metal passed the acid test, it was pure gold. If metal failed the acid test by corroding from the acid, it was a base metal and of no value.

The acid test of finance shows how well a company can quickly convert its assets into cash in order to pay off its current liabilities. It also shows the level of quick assets to current liabilities.

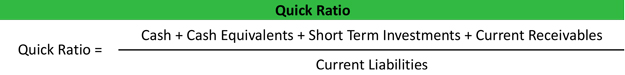

Formula

The quick ratio is calculated by adding cash, cash equivalents, short-term investments, and current receivables together then dividing them by current liabilities.

The acid current ratio numerator is current assets minus inventory. It is most liquid ratio i.e. how promptly meet the loan obligation.

A Inventory<<<<<<<<<<>>>>>>>>>>>>>>>>>>>

acid ratio or quick ratio is used to check whether a business would be able to pay off its debts by using its most liquid assets i.e. cash and near cash assets. therefore the numerator is current assets minus inventories and prepaid expenses, answer is A and C

Answer is

>>A-Inventory

acid ratio=current asset - inventor/current liability

The answer is A. Inventory.

The correct answer is A. The answer is there are some applied to answer C

Inventory...................................................................

Avez-vous besoin d'aide pour créer un CV ayant les mots-clés recherchés par les employeurs?